50 and 200 ema crossover how to#

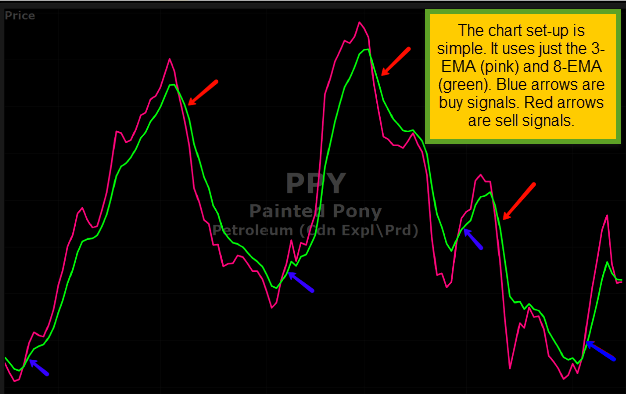

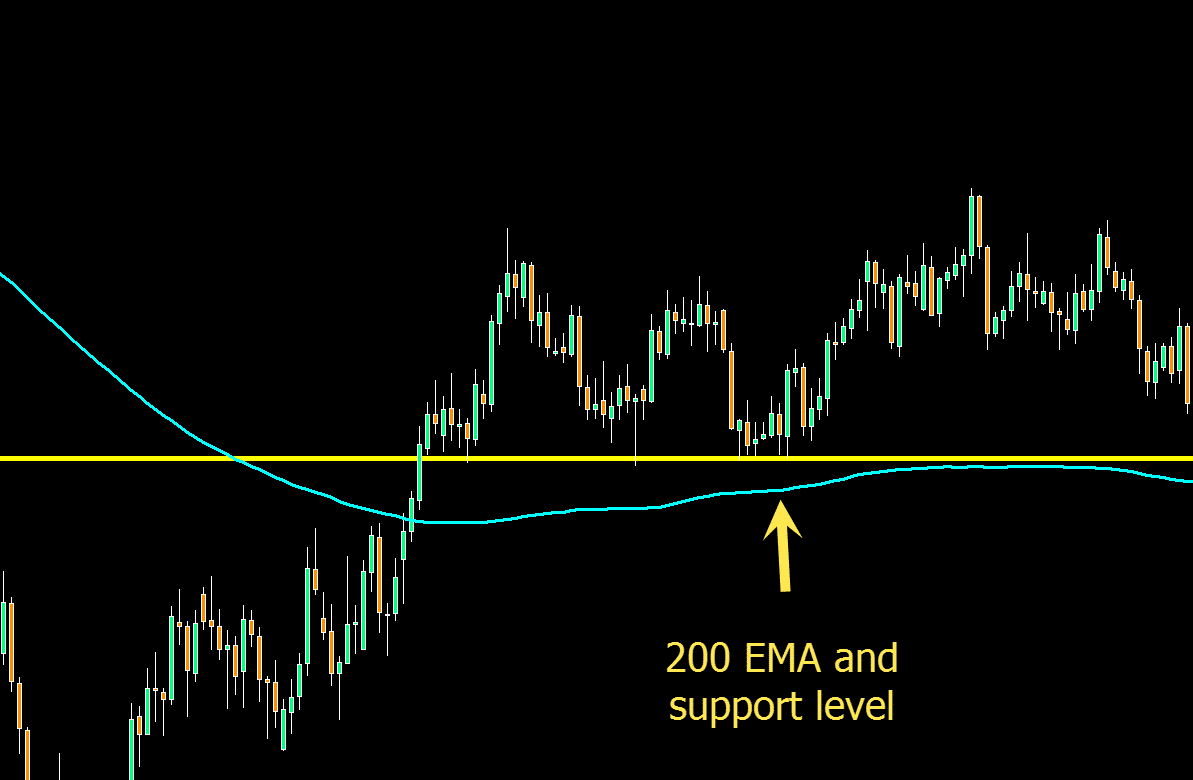

Thanks for reading down this far, hope that you share this…Thanks. cross above) EMA 12 is below 105 of EMA 50 (it’s a recent crossover and distance between the EMAs is small 5 of less) Last Price is above 100 of EMA 12 (this ensures that EMA slope is still up) Volume () is above 100,000 (some min liquidity) Below is a tutorial video on how to create this custom. risk:reward of this forex system is also good.in a strong ranging market this trading system can make you a lot of pips.Comparing the 50- and 200-day moving averages can be very useful for swing. easy trading system to understand and follow Want to build moving average crossover scans that identify prime trading.ema’s a lagging indicators…price moves ahead before a sell or a buy signal is generated later.ĪDVANTAGES of The 200 EMA And 15 EMA crossover trading strategy.in a ranging market, there’s going to be a lot of false signals.for take profit, use the previous swing low point…if none is available, aim for a risk:reward of 1:2 or more.ĭISADVANTAGES of The 200 EMA And 15 EMA crossover trading strategy.

look for bearish reversal candlesticks to go short when price touches the 15 ema by placing sell stop pending order at least 2 pips below the low of the bearish reversal candlestick.wait for price to go back up to touch the 15 ema.for take profit, use the previous swing high point…if none is available, aim for a risk:reward of 1:2 or more.The other one is using a 12 hour delay in between each new position. This test is using a 6 hour delay in between each new position. place stop lost at least 2 pips below the nearest swing low. Here is another example of EUR/AUD using this system: D1: Price is above BOTH the 20 EMA and the 50 EMA H1: Using Williams indicator we look to open our BUY positions once price hits 'over sold' area.look for bullish reversal candlesticks to go long when price touches the 15 ema by placing buy stop pending order at least 2 pips above the high of a bullish reversal candlestick. Kinda useful because Im using EMA 50 & 200 for my trading, so I can receive alert and know when to enter my trade without checking out myself frequently.When the 50 day SMA crossed below the 200 day SMA, it is called a death cross. wait for price to come back down to touch the 15 ema This is an important trading signal for institutional traders.The 15 ema is the indicator that signals a buy or a sell when price comes back to it and touches it.

If either of the conditions is met, we then wait for the following set up to appear: Sell Criteria. Or you will only look to take sell trades when the price is below the 200 ema line. This video shows a simple and clean forex trading strategy using the 50 ema and 200 ema which you can use as a beginner or even as a knowledgeable trader. Buy Bias: 50 EMA must have recently crossed over above the 200 EMA. The 200 ema acts as a filter in that you will only look to take buy trades when price is above the 200 ema line. This 200 EMA And 15 EMA crossover trading strategy is a trend trading system that uses two exponetial moving averages, the 200 ema and the 15 ema.

0 kommentar(er)

0 kommentar(er)